STRATEGIES

The Wallace Hart investment approach is focused on absolute return across market conditions. We focus on a range of strategies for different stages of your long-term investment horizon:

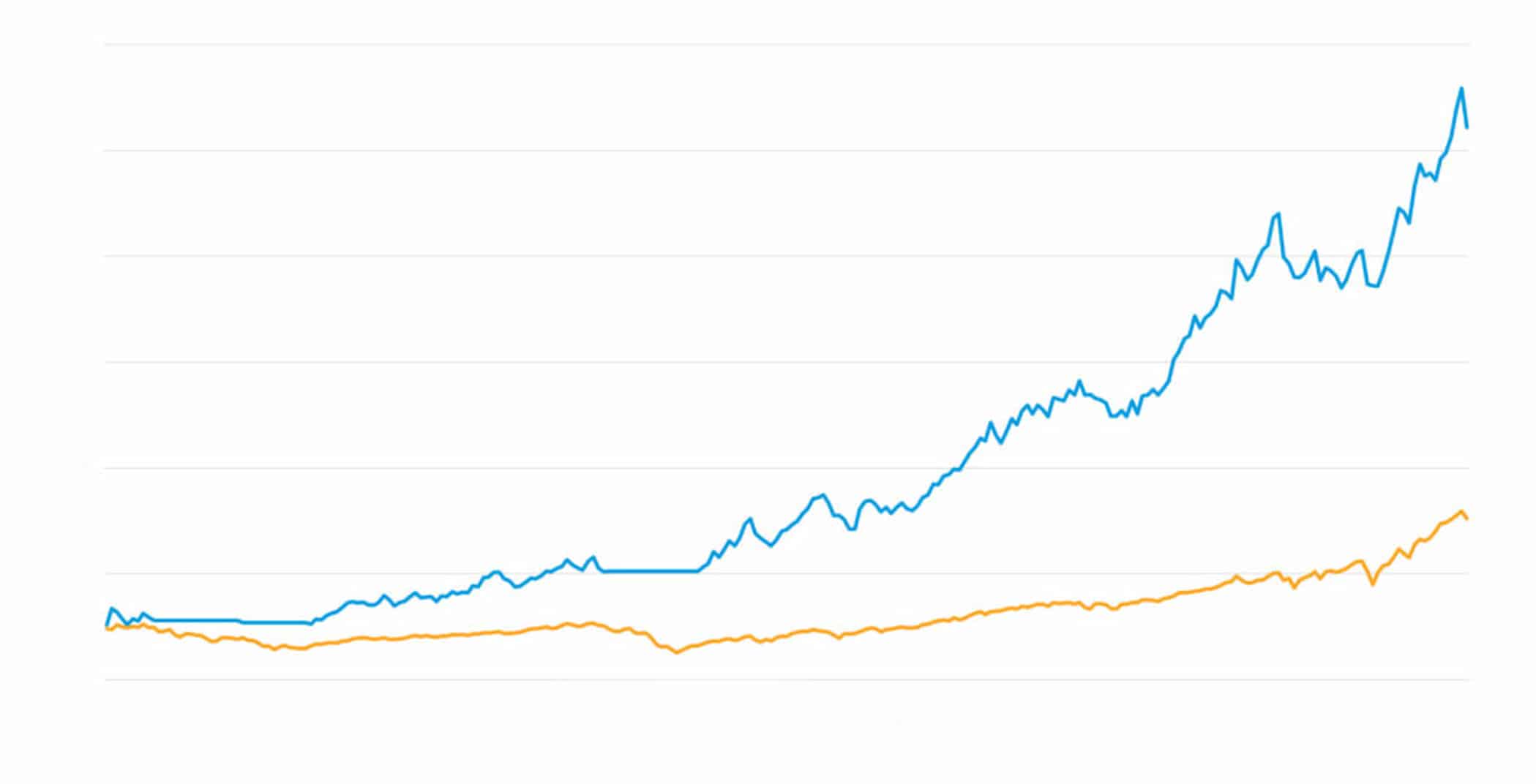

Our Wealth Creation Strategy is focused on the long-term growth potential of leading U.S.-based equities. We scour the market to select a diverse range of leading stocks and ETFs, which we feel have long-term growth potential.

These stocks are selected on our relative strength exhibiting innovative growth potential over a longer-term investment horizon. This approach offers both the benefits of diversification and the right amount of concentration to benefit from growth opportunities

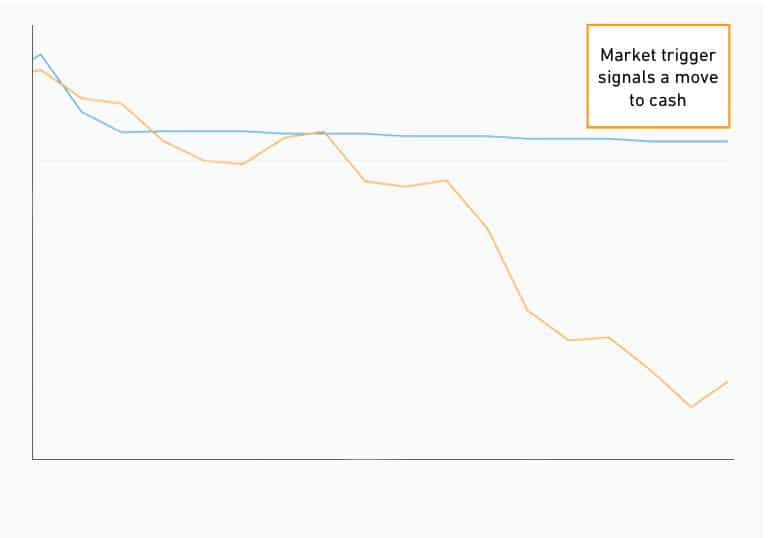

Our Wealth Preservation Strategy seeks to preserve wealth in today’s volatile markets. This strategy is dynamic in nature and can move to cash when the market exhibits negative signals.

Guided by technical signals from the market combined with decades of hands-on investment experience, our approach focuses on growth with the market trends upward and preservation when the market is in a downturn. This strategy was created to help investors avoid major market downturns while still participating in the ensuing rebounds.

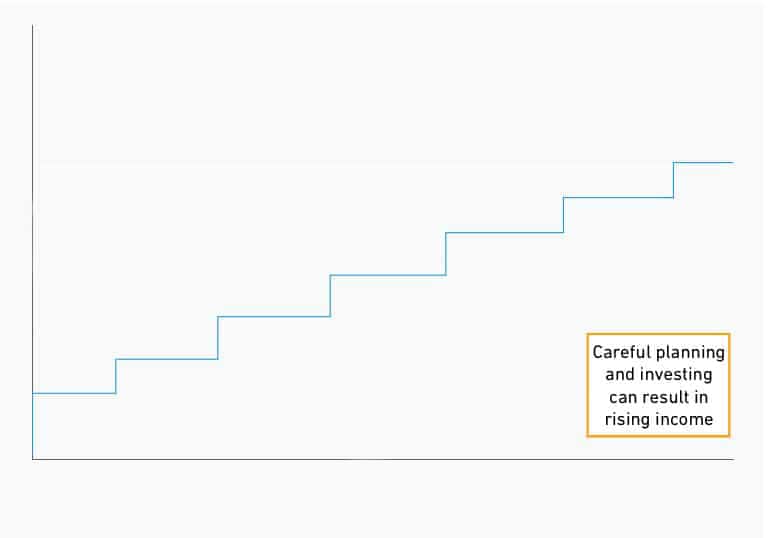

Our income generation strategy is an equity-based strategy that seeks to generate income for the long-term. We incorporate Social Security and pension-based income to satisfy income needs. With this strategy, we can enact a systematic withdrawal system, taking profits and capital gains as income, rather than a dividend approach.

With our Tax Smart Retirement Paycheck, we are able to show investors when and where they should take money from to be most efficient.

Disclosures

Sample only, not intended to represent any specific investment strategy.

Connect

Learn more about how Wallace Hart can help you imagine your life’s possibilities