By Jeremy Wallace and Andrew Hart

Unless you’ve been living under a rock, you’ve probably heard or read at least one news story on the coronavirus outbreak that is quickly spreading worldwide. While numbers change daily, as of this writing, at least 362 people have died from the pneumonia-like disease and almost 17,500 have been infected. (1) Since it has made its way into more than 20 countries now, (2) the World Health Organization has officially declared the coronavirus outbreak a global health emergency. (3)

These types of situations don’t happen in a bubble; they impact many aspects of society, not least of which is the economy. Here’s a look at the coronavirus, how it is impacting the markets, and what we might expect going forward.

Why Are The Markets Reacting?

Currently, the Dow Jones has dropped 2% and the S&P 500 1.6% in reaction to the virus’s spread. (4) The markets hate uncertainty and tend to respond with increased volatility, so travel bans, quarantines, and dramatic headlines are causing the markets to retract until things stabilize. China’s economy is the second largest in the world, so when China sneezes, the rest of the world feels the aftereffects.

With a virus outbreak, analysts are worried about both slowing consumption and production, as well as dramatically reduced travel to and from China. All these things could impact the bottom line of those countries and corporations that do business with China. The other uncertain factor is how far and fast this virus will spread. No one knows for certain how long the outbreak will last, how bad it will get, or how it will impact economic growth. The natural instinct, then, is to shut the doors, draw the blinds, stick the money under the mattress, and wait for the storm to blow over.

That’s exactly what some investors are doing right now, but one of the most important rules in investing is to refrain from making short-term emotional decisions, especially near market tops and bottoms. Multiple studies have analyzed how our emotions affect our investing results, especially when we chase above-average returns. A 2018 DALBAR study revealed that investors’ decisions were the biggest reason for underperformance. (5) Simply put, behavioral biases lead to poor investment decision-making.

A Look At History

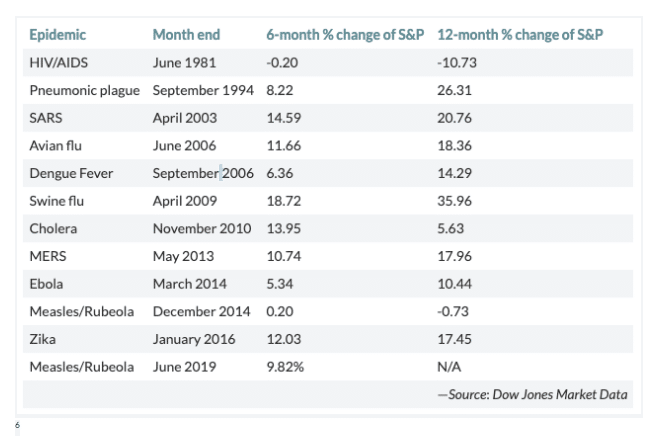

This is not the first time an infectious disease crisis has caused lost sleep, but does it really spell disaster for the economy? Between SARS, Ebola, and others, what we’ve seen happen is a short-term drop as news comes in, then a stabilization as we learn more of what to expect. Here’s how the S&P 500 has responded to other outbreaks, some much more extreme than the coronavirus so far.

The severity of the virus, ultimately, will dictate the market’s reaction and the impact on certain sectors of the market, such as travel and retail.

For a deeper dive, let’s go back to the SARS outbreak of 2003. In that case, SARS is estimated to have cost the world economy $40 billion. (7) The S&P 500 dropped 8.3% during that time, and many other stock markets suffered large losses, too. (8) But there are two things to remember here. First, the current outbreak is nowhere near what SARS was. Back then, nearly 800 people died in 17 different countries. (9) As of now, this virus is not as deadly. Furthermore, humanity’s ability to respond to it is much greater than it was 17 years ago, and China is taking this very seriously this time, putting a city of 11 million people on lockdown instead of hiding the spread of the virus as in 2003.

How Should We Respond?

While we can’t predict the longevity of this situation, we can keep a sense of perspective. These types of outbreaks often produce a temporary impact on the market, as seen in the chart above. This is in keeping with how global events usually affect the markets: a short, sometimes steep slide as investors try to figure out what’s going on, followed by a longer climb. Generally speaking, it takes long-term trends, or major changes to the economy’s fundamentals, to make long-term changes in the direction of the markets.

Your first step is to avoid overreacting to the headlines. Don’t hide under a rock, but remember that the media’s job is to grab your attention and make you panic. Instead, stick to your long-term strategy that was built to withstand dips and crises. Mentally prepare yourself for more volatility and rely on an experienced professional to help you understand your options and control the risk you take with your money.

Is Your Plan Prepared?

The only long-term guarantee in investing is that there will be short-term fluctuations. Regardless of what causes them, we’ll experience bull markets, bear markets, and volatility in the decades ahead just as we have in the past. Rather than fear change or uncertainty, focus on preparing for it. If you have questions about your portfolio or need to create a disciplined, long-term strategy to grow your wealth and preserve your capital, contact our team at Wallace Hart Capital Management by calling 859.300.3030 or request an appointment online today!

About Jeremy

Jeremy Wallace is founder and chief investment officer at Wallace Hart Capital Management, an independent financial services firm committed to offering comprehensive advice and customized services. Jeremy has 20 years of experience in the financial industry and is passionate about helping clients preserve and enhance their wealth so they can pursue their passions. Jeremy graduated from Emory University with a degree in international economics and a certificate in financial planning. Outside of the office, Jeremy spends most of his free time with his wife, Julie, and their three children, Isabel, Lincoln, and Reid. He is an avid Chicago Cubs baseball fan, and he enjoys golfing with his wife and traveling with his family. Learn more about Jeremy by connecting with him on LinkedIn.

____________

(2) https://www.cnn.com/2020/01/30/asia/wuhan-coronavirus-update-intl-hnk/index.html

(8) https://finance.yahoo.com/news/history-coronavirus-outbreaks-stock-market-204520997.html

2/3/2020